LST-NFTs: A New Paradigm

It is no secret that NFTs have not been the hot ticket item this cycle. Gone are the days where you would see multiple six-figure NFT sales gracing your timeline.

I think it is important to realize NFTs that do well in the future may look completely different to the NFTs we saw take-off last cycle. It is also worth noting that NFTs are not static. They are a dynamic asset class that is continuously evolving with new innovation and technology (Hybrid DeFi for example). With all this in mind, let’s dive into the brand new world of LST-NFTs.

Staking

In order to understand LST-NFTs, we first need to understand a Liquid Staking Token (LST). Solana uses a Proof of Stake (PoS) consensus mechanism which is run by block validators to ensure all transactions are secured and verified. This allows for entities, also known as “stakers,” to lock up SOL as collateral with validators in an effort to support consensus and secure the network. This process is known as traditional staking. As a reward, stakers earn yield on their SOL in addition to staking rewards.

Liquid Staking

Liquid Staking is a form of staking, combining the rewards of traditional staking with the additional benefit of liquidity via a placeholder token that accrues the yield. Traditional staking requires stakers to lock up their SOL which means they are not easily accessible for use. Liquid Staking allows staked coins to be readily available for use throughout the staking process.

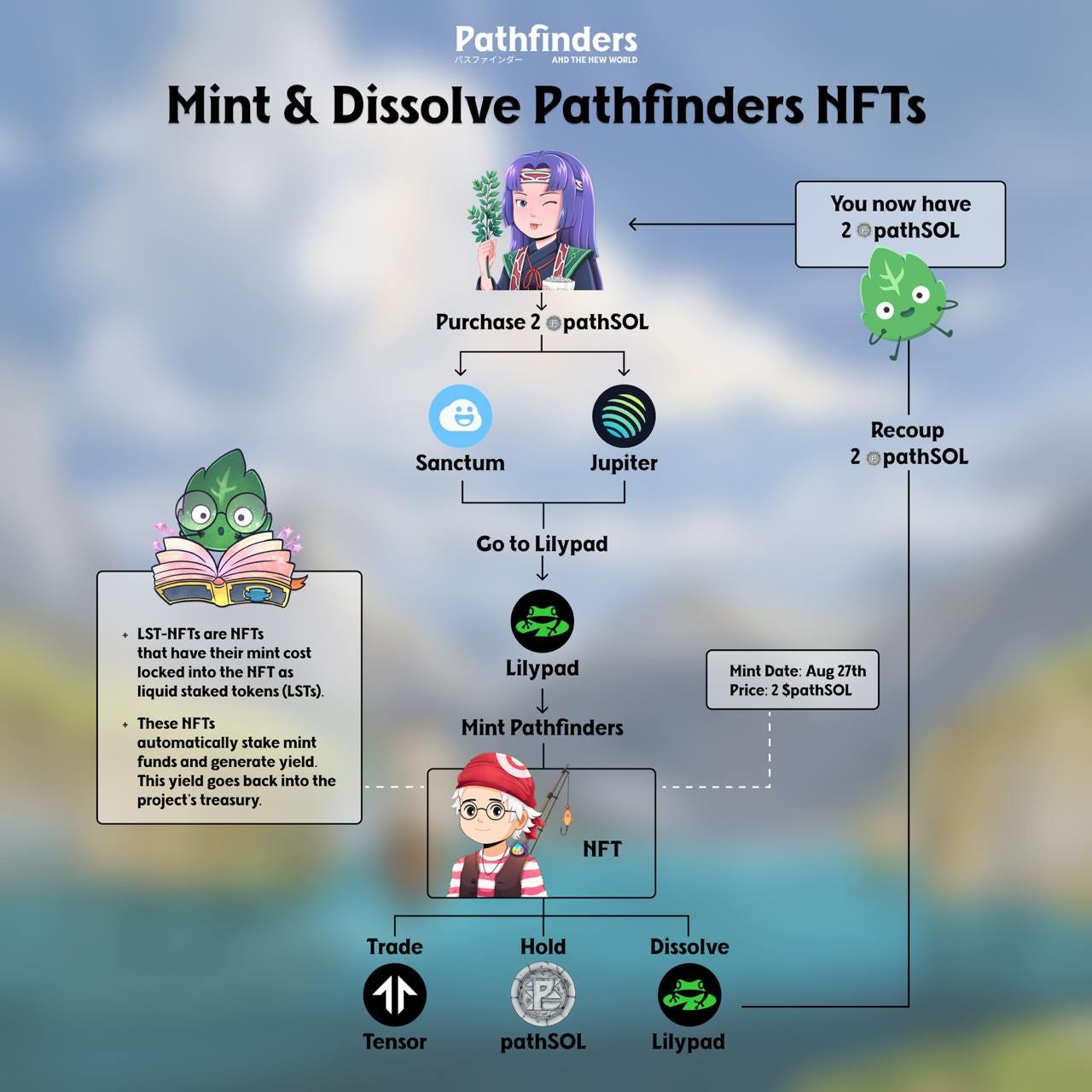

Now that we understand Liquid Staking, let’s dive into the brand new world of LST-NFTs being pioneered by the team at Pathfinders. With most LSTs, yield is returned to the LST holder with a portion being reserved for the underlying protocol. Sanctum however, has unlocked a variety of possibilities and unique uses for the yield generated by various projects LSTs. You can essentially earn yield, back your favorite projects by delegating your yield for a purpose or even perform actions with the accrued yield automatically. Using this framework with pathSOL (Pathfinders’ LST), the yield is allocated to Project Pathfinders to facilitate and fund the project’s growth, as well as enable the new LST-NFT standard.

Pathfinders has also joined forces with the Phase Labs team to build a LST-backed NFT launchpad called Lilypad.

According to Lilypad:

Leveraging pathSOL as the cornerstone of LST-NFTs, we are pioneering a new generation of funner, safer, and riskless NFT projects.

How does it work?

Powered by Solana's consistent staking yield, projects that launch through Lilypad will have the ability to accrue yield based on the amount of NFTs minted through pathSOL.

Other Exciting LST-NFT Ideas

Taking inspiration from Pathfinders here, LST-NFTs unlock a new variety of use cases. Subscription and Loyalty Program LST-NFTs seem like premier examples of ways that yield can be used to generate value and replace current user behaviors.

For example, staking a few SOL in a Subscription LST-NFT could grant you access to a monthly newsletter or magazine, think Business Insider or an exclusive game pass for XBOX.

In a similar fashion, if you are a super fan of a brand you can stake your pudgySOL and receive discounts on physical items, obtain exclusive sticker packs, access online events, and more.

Conclusion

Pathfinders will be the first project to launch on Lilypad. Does this start a new meta where users can recoup mint fees at any given moment?

In an era where liquidity extraction runs rampant, I for one am excited to see how the market reacts to this new paradigm.

To keep up to date with everything on Solana, be sure to follow us on X, browse our marketplace and subscribe to our blog.